7 Challenges in Testing for Banks

- September 6, 2021

- maira

QA testing has become crucial to any bank’s successful digital transformation. Whether it’s automated or manual testing, testing any banking applications or other forms of digital services, grants a bank the foresight to uncover bugs, anomalies, and errors that might affect performance, stability, security, and the overall effectiveness of their online banking platforms.

Having the right experiences, resources, and insight is important for executing a testing campaign. Bearing this in mind, here are some of the universal testing challenges that arise in the banking domain:

Compliance with security standards

The steady advance of digital technology, automation, and AI in the coming years is reshaping how consumers manage their financial assets. Banking websites and customer portals will continue to become growing targets for cyber threats – and this is likely to set off changes in regulatory frameworks. To keep up, banks are increasingly availing the services of cybersecurity and testing companies to maintain consumer privacy and mitigate the risks of fraudulent activity through financial technologies within their institutional frameworks.

Complex data

Because of the complexity of the data and the business rules surrounding this data, mining the appropriate data for test cases becomes challenging. Data migration from legacy software is often a major concern for banks owing to the sheer volume of data that often needs to be migrated for testing purposes. Kualitatem Inc.’s certified security practitioners routinely work with banks that require testing for upgrades from legacy to core banking software, data migration, cleansing, amidst other services.

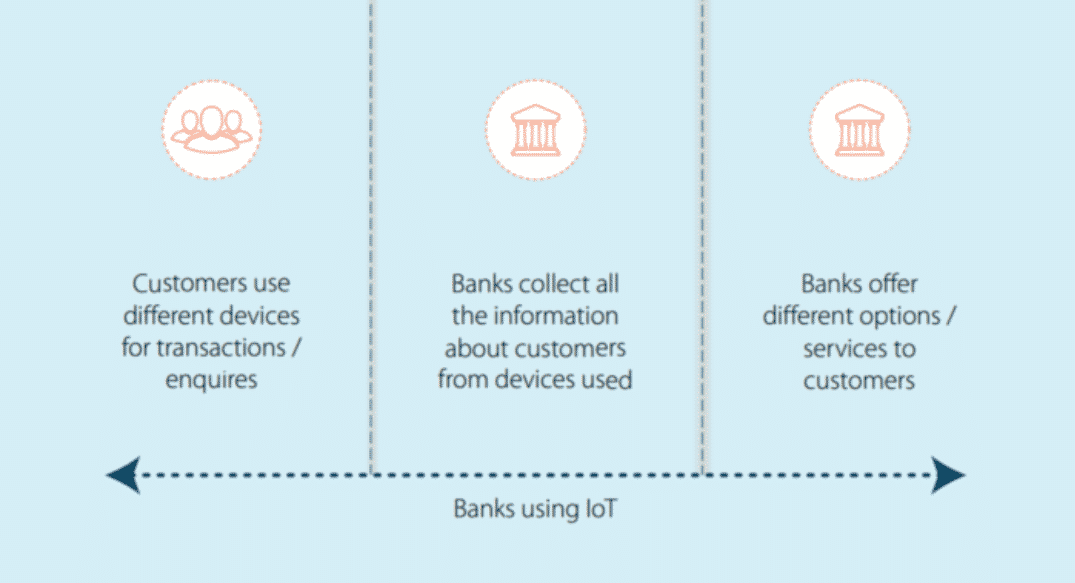

Offering multiple platform support

Another costly challenge is ensuring that the bank’s financial services are supported across mobile, desktop, and tablet devices. Remote access through multiple devices to banking services is increasingly a given for most consumers. That being said, banks and financial institutions are under growing scrutiny for their inability to maintain a) satisfactory levels of customer service and b) being unable to defend against cyber-attacks.

One of the primary reasons for this is the vulnerability of multiple fintech devices (and networks) to security threats. 2018’s Visa outage, for instance, is a good instance of this – users across UK and most of Europe were unable to perform transactions, and day-to-day tasks came to an abrupt halt while Visa worked to bring its payment systems back to normal.

Maintaining customer privacy

Bearing in mind the host of vulnerabilities created by evolving technologies, banks have multiple ways in which they have to secure their data; whether this is through authentication, maintaining audit trails, establishing secure infrastructures, secure processes, or other methods.

Monitoring real-time activity

Real-time payment activities pose an obvious concern for banks: how do banks protect themselves from fraudulent activity?

If the right, updated compliance software is in place, then concerns like being able to handle huge volumes of data on the daily, adjusting to evolving regulations, and keeping up with the speed of payment processing, are mitigated. Proper compliance software will ensure the functionality needed to keep up with regulatory changes, a way to assess breaches in compliance, and setting up proper monitoring for data transactions.

Adapting to changing market trends

Talk about how digital transformation is the new trend has been here for a while – and banks have little choice but to keep up. EY says that the highest performing banks outperform their peers by being customer-centric and that three things ensure this: securing data security and privacy protection, ethics and transparency as Artificial Intelligence (AI) and Machine Learning (ML) increasingly influence decision-making, and ensuring open communication in cases where data breaches do occur.

Testing banking applications isn’t an easy task – there’s a lot to bear in mind, and testers have to adapt to the specific context and needs of the bank they’re testing for. Involving an experienced partner ensures that the testing strategies being deployed are reliable, and will produce the results needed to meet your business goals – and banking applications that are free from vulnerabilities and performance-related issues.