End-to-End Financial App Testing Strategy for Scalable Enterprise Solutions

- July 25, 2025

- Zunnoor Zafar

Building and deploying enterprise-grade financial applications requires not just functionality. But, reliability and security. Along with a seamless user experience at scale.

As enterprises grow and their user bases expand. The need for a good end-to-end testing strategy that is tailored to the complexities of financial apps increases as well.

The main goal here is to ensure that every component of the application works smoothly. This includes the front-end user interactions to the back-end transaction processing. All this has to be done while maintaining compliance and security.

At Kualitatem, we understand this. Hence, we came up with this article, which will discuss a comprehensive approach to designing and implementing an end-to-end testing strategy. Specifically for financial apps, with emphasis on usability, security, and performance.

The Challenges of Testing Financial Applications

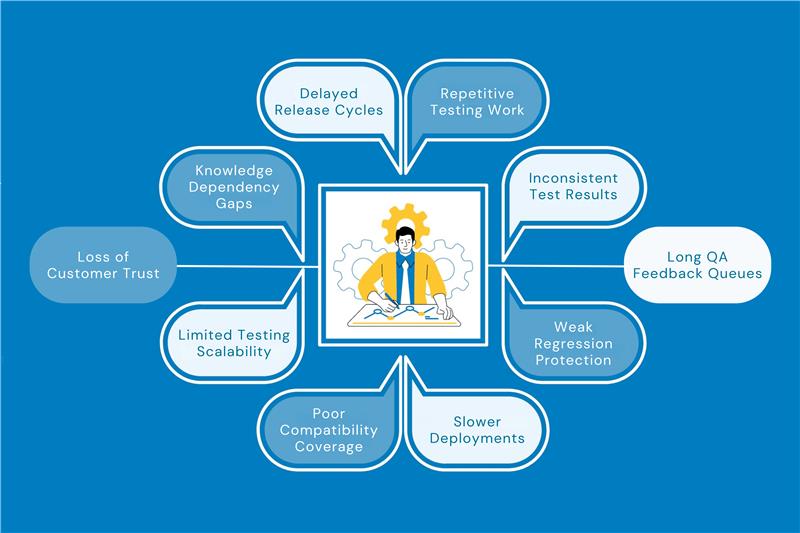

Financial applications are different from others. They’re a bit more complex and sensitive. This is mainly because they handle critical user data. High-stakes monetary transactions are done through them. And the applications must also comply with regulatory mandates.

Unlike typical software, flaws in financial applications can result in severe financial loss. Other than that, some key differentiators are:

- Complex Business Logic: Handling sensitive financial calculations. Along with funds transfer and audit trails.

- Data Sensitivity: Encrypted transmission and storage of sensitive personal and financial information of users.

- High Load & Scalability Requirements: Simultaneous transactions by thousands. Or even millions of users.

- Regulatory Compliance: Adherence to standards such as PCI DSS and GDPR. Also, to some other finance-specific regulations.

- Customer-Centric Usability: Intuitive and efficient user interfaces. So, that friction in user workflows is minimized.

Coming Up with a Good End-to-End Financial App Testing Strategy

We recommend following the steps below to come up with a reliable financial app testing strategy.

Step # 1: Define the Scope and Objectives of Testing

What are you trying to see with your testing? Firstly, you have to answer this. A precise definition of the testing scope has to be thought of.

In financial applications, this involves identifying business-critical workflows. Such as user authentication, fund transfers, bill payments, regulatory reporting, and transaction reversals.

One thing to keep in mind is that the objectives must be aligned with business goals. They should focus on verifying the functional correctness of financial calculations and transactions.

Apart from this, the objectives should also ensure good security protocols to prevent breaches. And to confirm regulatory compliance via audit-ready logs. Lastly, the performance should be validated under high load conditions.

Step # 2: Build a Comprehensive Test Plan with a Risk-Based Approach

Once a clear scope is determined, you have to develop a detailed test plan. It should outline the following things.

- Test scenarios covering end-to-end workflows. From login to transaction completion.

- Inclusion of functional testing, performance testing, security testing, and, not to forget, usability testing.

- Entry criteria (e.g., code freeze, test data readiness) and exit criteria (e.g., 90% of test cases passing, no critical bugs outstanding).

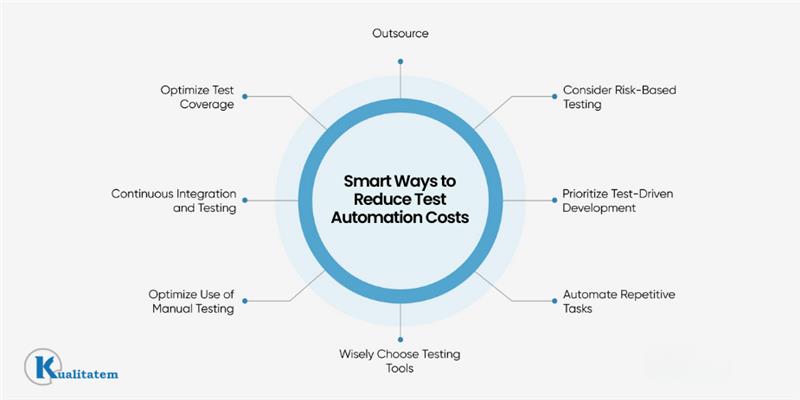

A risk-based testing approach is most important. You must focus on the highest-impact areas such as payment processing and compliance validation. This’ll help eliminate major risks early in the development lifecycle.

Step # 3: Make Use of Both Manual & Automated Testing

Yes, automation accelerates testing and increases repeatability. But manual testing is still needed. Especially for explanatory testing and assessing usability.

We recommend mixing both manual and automated testing to get the best results. You can automate regression tests that verify the stability of the app in continuous integration (CI) cycles.

AI-driven automation tools can be employed to generate smart test cases. Ones that adapt to code changes and increase coverage to reduce maintenance overhead. Additionally, performance and load testing to simulate thousands of concurrent users can also be automated.

On the other hand, focus your manual efforts on conducting exploratory and usability testing sessions like real users. Doing so will help validate user experience and identify their pain points.

Manual security penetration testing can also be done along with compliance audits that require human judgment.

Step # 4: Prioritize End-to-End Functional Testing Scenarios

Financial apps have workflows that are intertwined. To cater to this, functional end-to-end tests that simulate complete user journeys are needed, such as:

- A user registration followed by KYC (Know Your Customer) verification.

- Initiating a fund transfer while verifying debit and credit entries.

- Handling failed transactions and error recovery.

- Validating reporting and audit trail accuracy.

Test scenarios that cover both common and specific cases have to be developed. Once that is done, they have to be moulded into executable test cases. What this approach does is ensure broad coverage while managing resources.

Step # 5: Emphasize Security Testing Throughout

As mentioned before, security is paramount in financial applications. Considering this, it’s best to integrate security testing early and continuously. You should use vulnerability scanning, penetration testing and code reviews to detect weaknesses.

Not just that, validation of the encryption of data at rest and in transit is needed. Session management and role-based access controls also have to be secured.

Furthermore, the compliance requirements for security standards should be considered. This will mitigate risks of data breaches and financial fraud.

To make things easier, automated security testing tools integrated with a test management platform can be used.

Step # 6: Conduct Rigorous Performance & Scalability Testing

It’s pretty obvious that financial applications are often going to face unpredictable spikes in loads. This can happen after a weekend or when there are payment deadlines. Hence, you must:

- Stress test with simulated concurrent users and high transaction volumes to observe system behaviour.

- Test failover mechanisms and recovery processes to ensure uptime.

- Measure response time to maintain an acceptable user experience.

Without proper performance validation, scalability issues can always occur. They’ll threaten business continuity and cause revenue loss.

Step # 7: Integrate Usability Testing for Superior User Experience

Usability is a competitive differentiator. The higher it is, the more an enterprise’s users will be satisfied. There shouldn’t be any compromise on usability. Hence, it’s important to conduct usability testing with target user personas so real customers can be reflected.

Navigation simplicity, error handling, and accessibility compliance must also be validated. Then comes collecting qualitative feedback from users through surveys and interviews. Or maybe through direct observation.

Lastly, it is recommended to continuously refine UI based on usability insights. Doing so will increase customer satisfaction and adoption.

Usability testing complements functional testing. It ensures that the app is truly user-centric. Never take it as something optional.

Step # 8: Utilize Centralized Test Management & Continuous Collaboration

Managing complex test assets in a scalable enterprise environment requires a good test management platform. There are so many of them, but we recommend using Kualitee.

Some of the main benefits of using a test management platform include:

- Centralized tracking of test cases, results, and defects.

- Real-time visibility into test progress and quality metrics. It’ll be easier to make informed decisions.

- Facilitated collaboration between teams. i.e., development, QA, business analysts, and compliance.

- Support for continuous integration and delivery pipelines, ensuring continuous testing and rapid releases.

Easier Alternative: Choose Kualitatem

Judging by the aforementioned steps. It’s obvious that implementing a reliable end-to-end financial app testing strategy for scalable enterprise solutions can be a bit tricky. Not to mention how resource-intensive it is.

Many enterprises either lack the internal QA bandwidth. Or prefer to focus their core teams exclusively on product innovation and delivery.

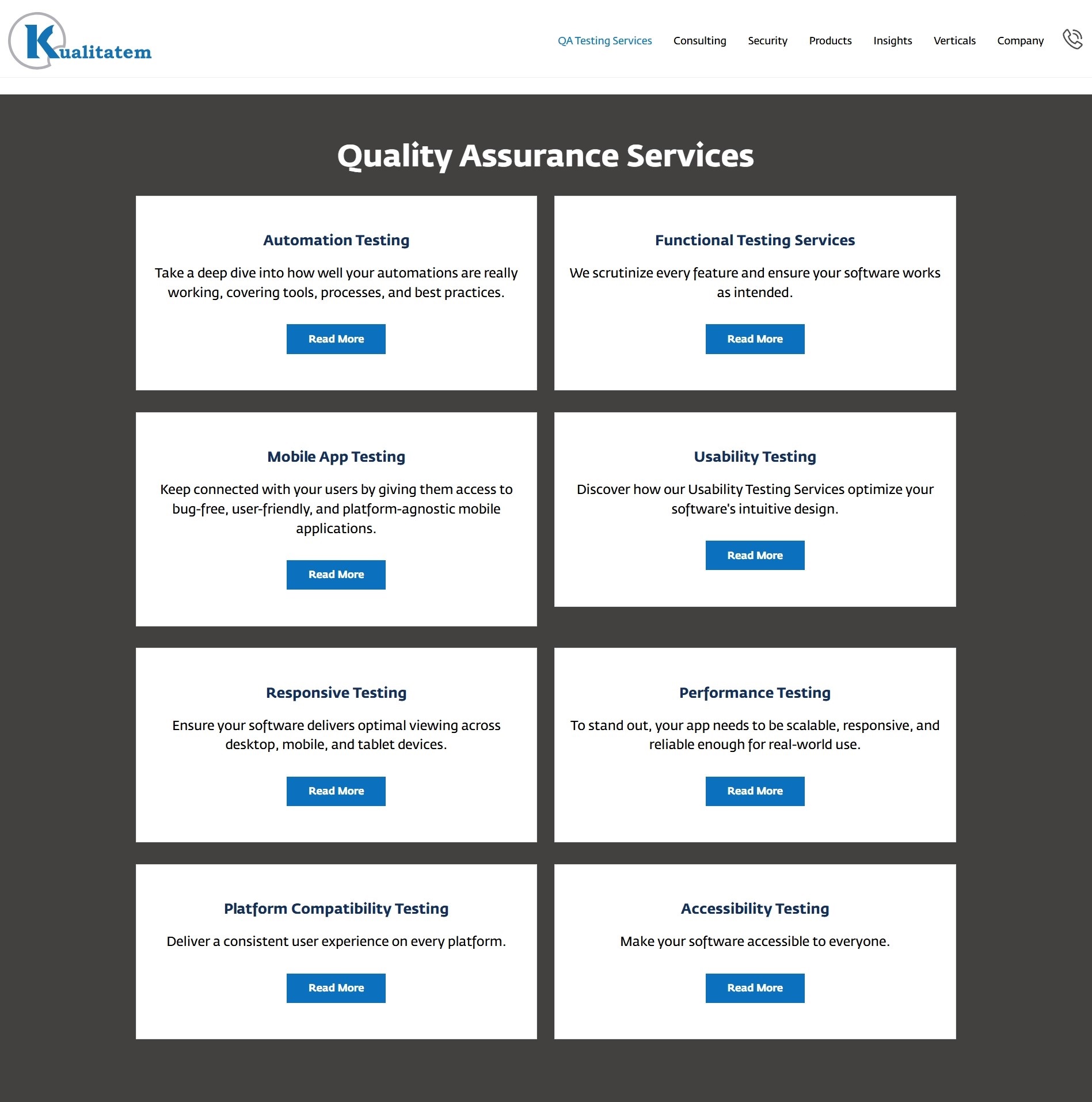

This is where Kualitatem comes in as a strategic partner. With over a decade of hands-on expertise in delivering QA testing services. Ones that are tailored specifically for banking, financial, and insurance organizations.

Kualitatem offers enterprises a proven, hassle-free alternative to building testing capabilities in-house.

By partnering with Kualitatem, your enterprise gains access to:

- End-to-end managed QA services.

- Comprehensive testing coverage, including usability.

- Scalable and flexible engagement models.

- Advanced automation and performance testing tools

- Seamless collaboration and transparent reporting.

As financial enterprises face growing pressure to innovate quickly while maintaining quality and security, Kualitatem stands ready to assist them in QA testing. Instead of investing heavily in building your own QA strategy and teams, you can give this task to seasoned experts who do this every day. It’s convenient and cost-effective.

Takeaway

Developing an effective end-to-end financial app testing strategy is important for enterprises. That’s because such apps are complex, sensitive, and have to fulfill regulatory demands.

The first two steps to go about this include defining the testing scope and creating a test plan. Next comes mixing manual, automated testing, and prioritizing functional as well as security testing.

Then there’s performance testing and emphasis on usability, along with utilizing a centralized test management platform.

Given the challenges of in-house QA, enterprises can partner with experts like Kualitatem. This way, they’ll get a resource-effective solution for ensuring quality. As well as security and user satisfaction in their financial applications.