Creating a Robust QA Governance Framework for Financial Institutions

- December 10, 2025

- Zunnoor Zafar

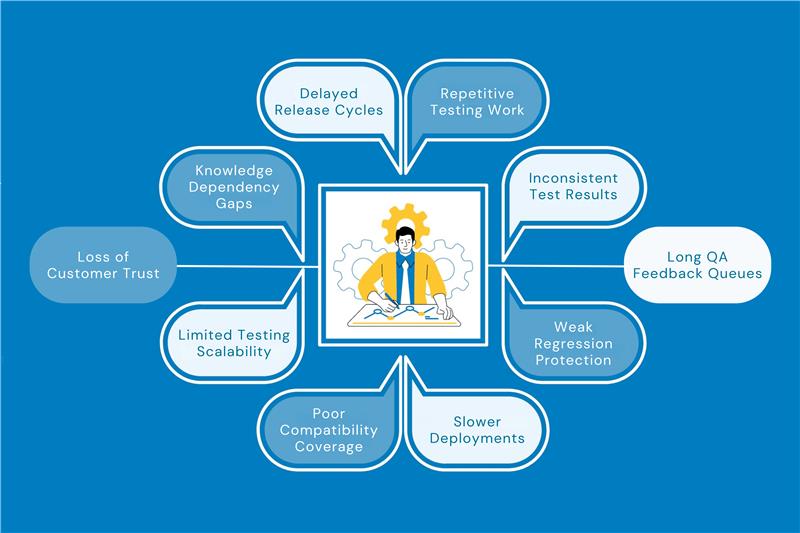

Financial institutions have to follow 10 to 20 major regulatory and software compliance frameworks on average. Any sort of failure in software quality can have serious consequences for them.

So, to make sure everything works smoothly, a top-notch Quality Assurance (QA) governance framework is important.

For these institutions, a QA governance isn’t just about preventing bugs; it has to establish a sort of control that ensures accuracy. The digital eco-systems should all be aligned and interconnected so customer data doesn’t get lost, and they don’t have to face any issues.

That said, this post will explore how financial organizations can establish good QA governance.

What Exactly Does QA Governance Mean in Financial Organizations?

Putting it simply, QA governance provides a structured framework for all quality assurance operations in an organization. It has five main dimensions that, when applied, extend maturity to the operations. The dimensions we’re talking about are:

- Governance and oversight: The executive bodies that make sure the QA strategy aligns with the risk and objectives of an organization. These are cross-functional steering committees that are made and charged with defining the QA policies. They also drive implementation.

- Defined roles and accountability: The responsibilities of everyone are clearly defined. QA leads, test managers, business operations executives, and other roles are given to the employees.

- Standardized processes and protocols: Documents and policy guides that help everyone understand how things are done are made. Test planning, data quality, and security testing. Everything is mentioned in them.

- Integration of tools: To make things easier for the employees, automated test management, data profiling tools are integrated into the workflow. These tools are also used to help practice stuff related to QA.

- Reporting Metrics: KPIs for defect resolution, test coverage, cycle time, automation rate, and more are defined. The executive bodies are reported regularly with full transparency.

By following this approach, quality assurance becomes more than just testing. It becomes strategic, and processes are carried out at a much better pace and accuracy.

Why does QA Governance Matter So Much?

A good QA governance in financial organizations offers benefits in several areas. The following are some of the prominent advantages.

1. Complete Regulatory Compliance

As we mentioned earlier that these institutions have to comply with various frameworks. They include Basel, FDIC, GDPR, PCI DSS, and many more. QA governance helps financial organizations ensure consistent validation and always stay ready for audits and inspections.

With QA governance, the records are all traceable and can be accessed by the authority holder at any time. This leads to transparent communication and KPI adherence.

2. Higher Operational Resilience

Critical systems like banking apps and trading platforms must keep working even when they’re under stress. They should also be protected from cyberattacks. With a high-end QA governance, performance, security, and recovery testing are ensured.

Real-world attack simulations are conducted to see if the system breaks under pressure or if it’s crackable.

3. Better Data Quality & Integrity

Pretty much everybody knows that finance is driven by data. Reporting, risk management decisions, and fraud detection, among other things, are highly dependent on data.

Apart from these things, the customer information should be accurate, secure, and audit-controlled. QA governance integrates processes like validation, cleansing, and monitoring to make sure the data quality and integrity remain intact.

4. Greater Trust Among Customers

It’s obvious that smooth, error-free digital experiences will make customers happy. They will be satisfied with their choice of the financial organization. QA governance helps achieve this goal since it leads to proactive defect prevention rather than reactive firefighting.

Furthermore, since customers would see the organization as trustworthy, there’s a higher chance of them referring it to their fellows.

5. More Efficiency & Agility

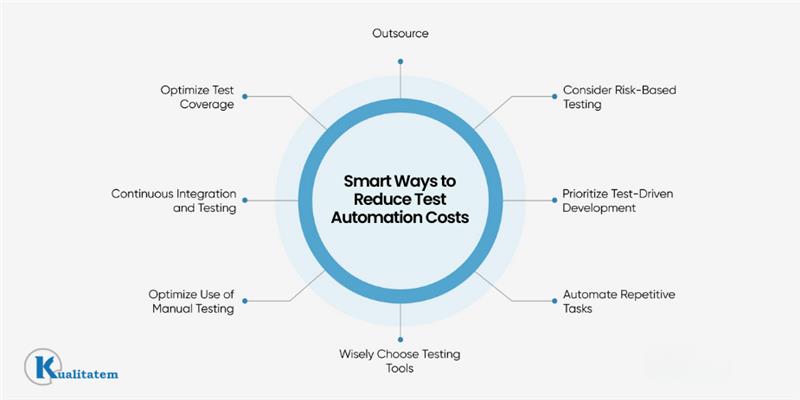

Since QA governance includes automation, manual effort is reduced. Test and defect management can be carried out using special tools, and they can also be prioritized based on their severity.

This way, delivery is accelerated, employees become more efficient, and the workflow becomes more streamlined.

Practical Implementation Roadmap for QA Governance

Implementing a good QA framework in financial institutions is a structured journey. There are multiple steps, and each one builds on the previous. This ensures momentum, alignment, and continuous improvement. That being said, the steps are as follows.

1. Initial Assessment and Planning

The first thing is to evaluate where your organization currently stands. Keep a realistic baseline and acknowledge existing efforts while highlighting gaps.

It’s recommended to compare your capabilities to already existing well regarded frameworks. Some example frameworks that you can see are: ISO 31000 for risk management, COSO for internal controls, COBIT for IT governance, and any local guidelines provided by the respective government.

Doing all this is going to help you clarify what’s in place, what’s missing, and what’s most urgent. The result will be a prioritized roadmap that aligns with business risks and compliance obligations.

2. Establish a Structure

You can’t establish a good structure without a qualified governance body. So, do the following things:

- Make a QA governance committee. One who is cross-functional and knows their stuff. Bring in members from QA, IT, risk, compliance, and business departments.

- Always appoint an executive sponsor. They should be someone who is willing to take ownership and responsibility. Accountability can be assured this way.

- Define roles in the committee. Who will be the committee chair, the group lead, and the escalation manager?

- Specify who’s going to give the go-ahead for when there’s a need for policy approvals, risk oversight, or investments.

3. Framework and Documentation

Create a handbook or other documentation that clearly states policies. Use narrative documents to convey expectations. Once that is done, turn your head towards making playbooks and checklists. These will help employees fulfill the expectations.

To exemplify this, let’s say a QA governance policy requires your organization to describe test data controls, regression gating rules, and compliance checkpoints before deployment. The supporting documents, such as test-data standards, automation guidelines, and CI/CD governance requirements, that you provide to your employees along with these policies, make expectations known.

Also, to take things further, you can map these documents to regulations that external auditors can understand.

4. Pilot Program

This is perhaps the most important step in the process. Before applying the new QA governance rules to your entire organization, it is recommended to test them on a small, controlled project first. This small project is known as a pilot.

It could be anything, your mobile banking app or customer portal. Choose something that is important but manageable. What this’ll do is:

- Validate if the governance policy is even applicable or not.

- Help you know about the test coverage, defect leakage, and automation efficiency beforehand.

- Enable the organization to refine documentation and committee workflow, if needed.

Basically, a fitted pilot helps prevent large-scale mistakes by letting you know about the shortcomings before QA governance rules are mass-applied. If everything goes well, expand the governance rules.

5. Tool Integration

If your organization is already making use of automation tools, embed governance into the toolchain. If not, well, achieve automation by doing these couple of things:

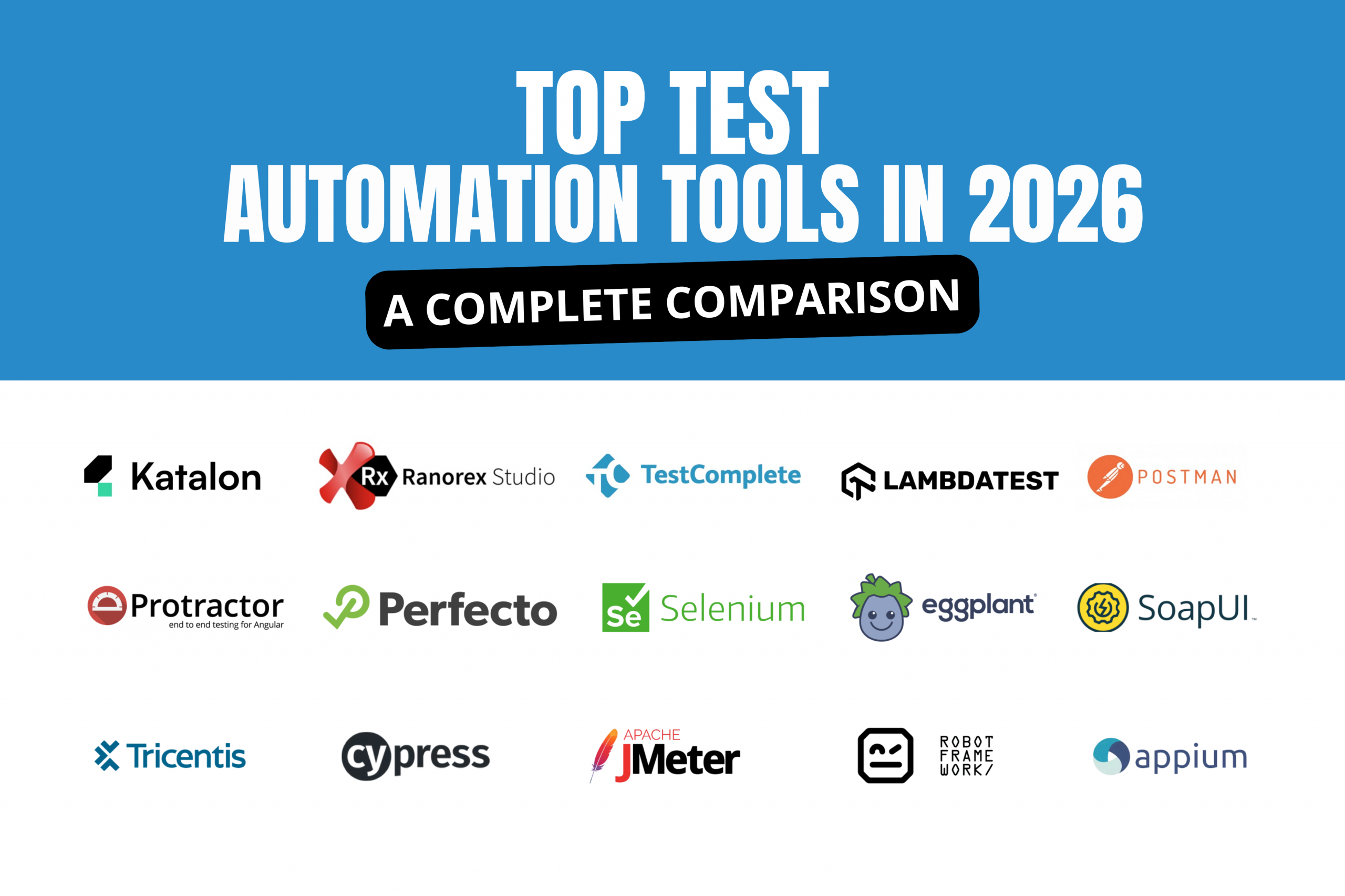

- Select a test-management platform. It should be one that provides traceability, access control, customizable dashboards, and integration with ticketing and CI/CD tools. A case in point is Kualitee. Or you can go with anyone that you like.

- Integrate automation suites into workflows. For example, Selenium/Cypress for UI, JMeter/Gatling for performance, and Fortify/OWASP for security.

6. Change Management & Training

In order for the governance to stick, people need to understand it and buy in. Hence, this step is all about training your organization’s employees. Making them comfortable with the changes being made.

Conduct workshops tailored to the role of each individual. Developers, QA, risk managers, and business stakeholders, leave no one behind. Educate them on new policies, automation practices, and tool usage.

Once you think that the training is complete, gather feedback. Along with this, try and track progress. These things will help address resistance early on.

Lastly, this is optional, but it does bring positive results: establish a communication plan. One that highlights wins and shares the lessons learned.

7. Ongoing Loop of Quality Checks and Improvements

Set a regular, repeated schedule of checks to keep the QA governance running smoothly and under control. You can:

- Take weekly QA reviews to keep day-to-day executions aligned.

- Conduct monthly governance meetings. The whole committee should sit together and review key metrics, pilot progress, and policy updates.

- Perform quarterly audits using frameworks such as COBIT or COSO to verify adherence.

These checkpoints will strengthen governance and ensure transparent auditing. They will also emphasize board-level oversight and risk communication.

Takeaway

QA governance helps ensure that everything works smoothly for financial institutions. It enables them to achieve complete regulatory compliance, better operational resilience, greater trust among customers, and more.

There are 7 steps to effectively implement QA governance in an organization. These steps include assessment and planning, establishing a structure, creating policy documentation, implementing a pilot program, integrating automated tools into the workflow, providing training to the employees, and conducting continuous checks.