Resource Strategies for QA Testing Services in the Financial Sector

- June 26, 2025

- Zunnoor Zafar

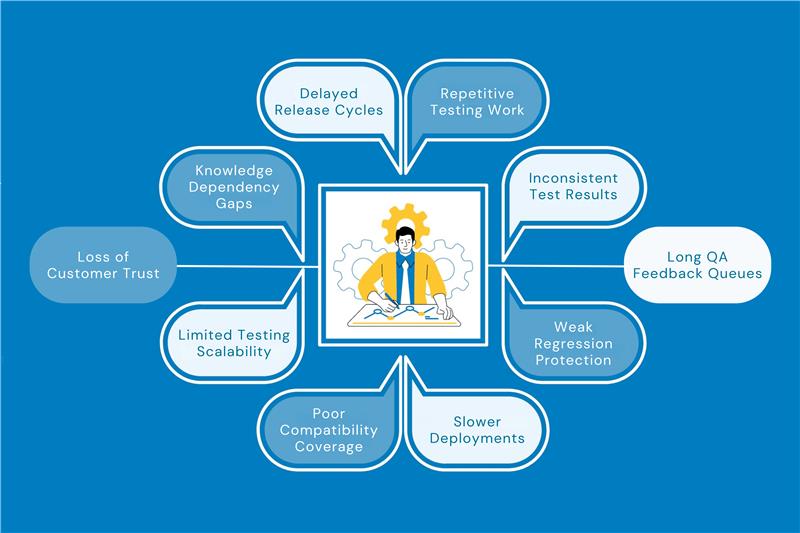

Financial organizations continue to go digital. The demand for online banking has grown quite a lot over the past few years. This, in turn, has also increased the demand for QA testing services for financial applications.

Whether it be banking apps or complex back-end systems, financial institutions are under great pressure. They have to deliver a smooth user experience. All while maintaining security and adhering to compliance regulations.

However, doing this requires resources. And it’s understood that spending too much can cause issues in the long run. So, how can the financial sector optimize its resources and ensure thorough, efficient, and cost-effective QA? Where should they spend first? We’re going to answer this today.

The Unique Demands of Financial Application Testing

Financial applications are unlike others. They have to guarantee a few things. Those are:

- Transaction Integrity: Even minor calculations can’t have errors. Transactions have to be done correctly. Otherwise, there’ll be issues.

- Regulatory Compliance: Strict regulations are put in place for the finance sector. It is required to adhere to them. Some common ones are SOX and PCI DSS. Furthermore, PSD2 and GDPR are also used in many places. Failing to abide by them may lead to fines.

- Market Data Integration: Data is king. Well, at least for the finance sector. They have to validate real-time data feeds and complex transactional flows precisely. One error, and customers could face various issues.

- Security: Fraud prevention and data protection hold high importance. Organizations can’t ignore these things.

- Auditability: With compliances come audits. Every action must be traceable. It should be transparent and have a positive outcome.

Given these challenges, resource strategies for QA testing services must be both comprehensive and adaptable.

Strategic Resource Allocation in Financial Application Testing

The following are some areas where financial institutions should spend more of their resources to optimize their QA efforts.

1. Building a Specialized QA Team

Generic QA skills aren’t enough for financial applications. The testers must have a deep knowledge of banking products and regulatory frameworks. They must also know about transnational flows.

It’s recommended to always invest in domain-specific training for QA professionals. Partnering with vendors who specialize in banking software testing is also a good idea.

This ensures that the team working for you is qualified enough to identify nuanced issues. Ones that generalists might overlook.

Besides this, you should allocate roles for each QA team member. Here are a few to consider:

- Team Leads/Managers

- Domain Experts

- Automation Engineers

- Security Testers

- Performance Testers

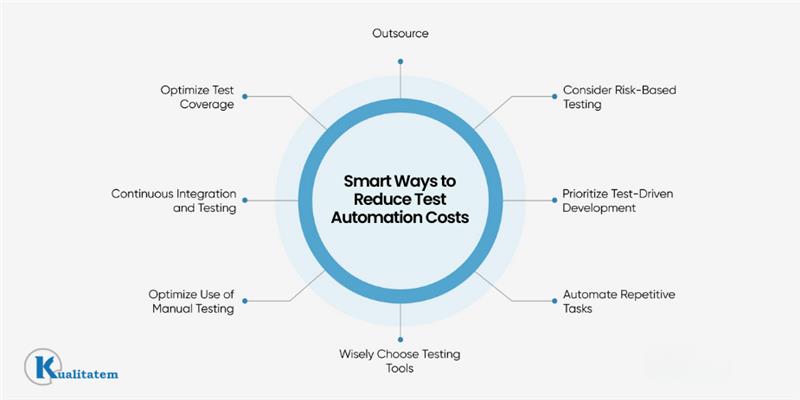

2. Adopting a Risk-Based Testing Approach

It’s understood that not all components of any financial institution carry equal risks. Some might cause more havoc than others. Thus, prioritizing testing efforts helps in the optimal use of resources.

To put this into perspective, take critical transactional flows as an example. They include payment processing, funds transfer, and account management, right? All of them receive top priority. Test these areas rigorously first.

Apart from this, the APIs connecting payment gateways, market data providers, and other third-party services also have to be tested as a priority. Other things come later.

3. Leveraging Automation for Efficiency & Coverage

It is reported that banks automate ~84% of QA tests. Why? Because software quality assurance includes many repetitive tasks. There’s also regression testing that has to be done for financial applications. These things can be automated to save time and resources.

Automated scripts can quickly validate thousands of scenarios. Interest calculations, balance reconciliations, and data migrations, to name a few. Meanwhile, testers can focus on other complex tasks.

We recommend integrating automated tests into CI/CD pipelines. This way, you’ll have the peace of mind that every code change is validated against compliance requirements. Deployment would become tension-free since the chances of new defects popping up would be minimized.

Having said that, some other key areas where automation can be applied are:

- Security testing. i.e., static code analysis and vulnerability scanning.

- Performance benchmarks under various load conditions.

- Test Case Generation

4. Centralizing Test Management and Analytics

Financial organizations are encouraged to adopt centralized test management platforms like Kualitee. This is because standalone testing tools can create inefficiencies in QA testing services and processes.

The centralized test management systems have everything in one place, like the test plans, execution logs, and defects. Teams don’t have to juggle between apps. Furthermore, real-time dashboards that show defect density, execution coverage, and escape rates are also present in them.

Using this information, the workload can be divided effectively among the team. Lastly, with one centralized platform, financial institutions don’t have to pay for licensing and maintenance of multiple tools. This saves them resources.

5. Hybrid Outsourcing (Onsite + Offshore)

Internal teams may lack the specialized expertise for certain aspects of banking software testing. Hybrid outsourcing offers more strategic ability.

The core business activities, such as payments, fraud detection, and encryption, can be assigned to financial application testing experts on-site. Meanwhile, offshore teams can be scaled rapidly. They’ll handle regression suites, lead tests, and stuff like compliance checklists.

With focused SLAs and a focus team both on-site and offshore, quality is maintained while cost is controlled. Routine testing becomes more affordable since senior testers are reserved for critical work.

6. Collaborating & Communicating Regularly

To make QA testing services in the financial sector more effective, it’s important to collaborate.

Every once in a while, financial institutions should bring the developers, business analysts, compliance officers, and testers together in one place.

Reviews should be taken from them. They have to be asked if everything is going fine. Gathering their thoughts and working on them will help define quality criteria, risk tolerance, and compliance needs.

Additionally, spend resources on making documentation like guides and requirements checklists. This will ensure the alignment of QA processes with business goals and compliance.

7. Continuously Improve Processes & Governance

The best QA testing services and processes evolve with industry demands. They aren’t static. Finance institutions should:

- Conduct regular audits of tools, processes, and metrics.

- Learn from post-release retrospectives and audits.

- Stay updated with innovations. New AI models, codeless tools, and risk-based frameworks are continuously coming out in the market.

- Update resource plans annually. This will balance QA coverage and cost.

Besides these things, it’s best that the financial sector provides training, workshops, as well as knowledge sharing sessions to their quality assurance teams. This will foster a culture of continuous improvement.

End Note

So, we’ve established that the financial sector must adopt strategic resource management in QA testing. Organizations can do it by investing in specialized teams, adopting a risk-based testing approach, and leveraging automation.

Not just that, centralized management, hybrid outsourcing, and regular collaboration are also important things.

Lastly, resources should be spent to continuously improve QA processes and governance. These are areas where there’s always going to be high returns on investment. Whether they be in the form of improved software quality, customer satisfaction, or profit margins.