Defining and Implementing Effective Defect Severity Levels in Banking Projects

- June 13, 2025

- Zunnoor Zafar

It’s no secret that banking applications process lots of sensitive customer data. They also handle a huge number of transactions each day and must comply with strict regulatory standards.

A single software defect can have dire consequences. Financial losses, damaged customer trust, and regulatory penalties, to name a few. This is why defining and implementing effective defect severity levels is considered a strategic approach for banking software applications.

Today, we’ll talk about what this approach is. We’ll also look at how banking applications can embed it into the defect management process to reduce the risk of a fallout and enhance software quality.

What Exactly is Defect Severity?

To measure the extent to which a particular issue affects the system functionality, performance, and security is called defect severity.

When it comes to banking applications, severity is usually determined by the quality assurance team. They see how much disruption in business processes or user activities is caused by a bug.

Many people confuse defect severity with priority. Hence, it is worth mentioning that severity indicates the fallout of a defect. On the other hand, priority determines how urgently an issue has to be fixed. Both are different things.

To exemplify, let’s say you find a security vulnerability in a banking program. It could have critical severity and high priority. Conversely, a minor UI typo can have low severity but could be considered high priority if it affects customer perception.

Why Severity Matters in Banking

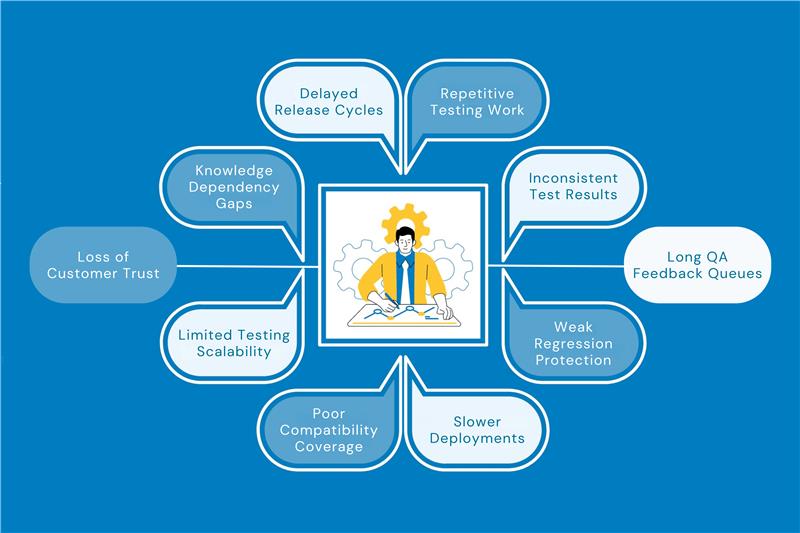

Banking systems are complex. They’re interconnected and handle the financial records of every customer. When a software defect occurs, it isn’t just something that can be ignored, especially considering the context. Operations can be halted, and the bank can suffer unimaginable losses.

According to industry studies, the average cost of a critical software failure in banking can exceed $500,000 per hour. Yes, PER HOUR.

So, without clear severity guidelines, teams risk misallocating resources. They might either end up over-prioritizing other issues or underestimating critical flaws. This can delay the resolution of high-impact defects, in turn increasing operational risk.

Standard Severity Levels in Banking Projects

Severity scales can be customized by every organization. However, a general model includes four or five tiers. This is what most banking projects adopt. The following breakdown will help you understand it better.

| Severity Level | Description | Example in Banking Context |

| Critical Severity | Complete system failure. Core functionality is lost, and operations are halted. Immediate resolution is required. | Login failures, unauthorized access to accounts, or other security breaches. |

| Major Severity | Major features are broken. The impact is usually severe, but some functions still work. Prompt attention required. | Failure in payment processing, transactions not going through, or irregular fund deductions. |

| Medium Severity | Non-essential features are affected. Workarounds are usually available for such defects, and they are addressed as part of regular maintenance. | Incorrect account balance display or minor calculation errors. |

| Minor Severity | These are the design or trivial defects. Core functionality isn’t affected at all, and a fix can be scheduled in future releases. | Typos, or UI misalignments. |

Best Practices for Implementing Effective Severity Levels

Since you now know the general defect severity levels. It’s time for us to tell you how to implement them effectively in banking projects. The following measures should be taken.

1. Establish Clear and Contextual Definitions

It’s best to customize severity definitions for your team. They should reflect banking-specific risks. i.e., regulatory compliance, transaction integrity, and customer trust, among other things.

Besides this, we recommend using real-world scenarios to illustrate each severity level for training and documentation. This increases clarity, and your QA team will understand everything better.

2. Integrate Severity into Defect Management Workflows

Defect management and tracking tools like Kualitee can help streamline your workflow by a mile. Enforce severity classification in such tools at the time of defect logging.

Also, if it is supported by guidelines, there’s a good chance that QA teams will remain consistent and know what issues to work on first.

3. Conduct Regular Defect Triage Meetings

If you’re working on a big banking project, regular defect triage meetings can prove to be a lifesaver for you. They can be weekly or even bi-weekly, but do start conducting them.

Bring together cross-functional teams, like QA, development, business, and compliance, to review and confirm severity assessments. Make adjustments as needed, ensure everything is aligned with your goals, and is making an impact on the business.

4. Continuous Training and Calibration

Provide ongoing training to QA business teams. Introduce them to new severity definitions and concepts. While doing so, don’t forget to give them examples of real-world scenarios. This way, they’ll learn new things and continue to thrive.

On top of this, we recommend conducting calibration sessions. These sessions will help you ensure consistency and severity ratings across all teams and projects.

5. Root Cause Analysis for High Severity Defects

Once a resolution for a high-severity defect comes through, the best thing to do is to conduct a post-mortem review of what exactly happened.

Document the lessons learned and make changes to severity definitions, if needed. Doing so will help identify systematic issues and update processes accordingly.

Common Pitfalls in Severity Levels and How to Avoid Them

When implementing defect severity levels in banking projects, organizations can come across a few pitfalls. These are fairly common, and dealing with them is easy.

- Overuse of high severity levels:

Many banking QA teams have the temptation to label every defect as major severity. This dilutes its meaning and can delay response to truly critical issues.

So, it’s best to reserve major severity strictly for critical failures that block core banking operations or risk data integrity. Lower-impact bugs should be classified at an appropriate severity level.

- Blurring Severity and Priority:

A common misstep is treating severity and priority as the same thing. However, as we mentioned, they’re not the same.

Considering that, enforce separate fields for severity and priority in your defect tracker and make it standard to discuss each of them individually in a triage session.

- Lack of Governance Adherence:

Even the best severity framework is useless without governance. If triage meetings are skipped, it’s obvious that severity will be assigned inconsistently. Not only that, but deployment might also proceed with unresolved issues.

Hence, you must make severity review a non-negotiable checkpoint in your deployment process. Hold regular triage sessions that include QA, dev, product, and compliance leads.

Final Words

Implementing effective defect severity levels in banking projects remains important to ensure the security, functionality, and integrity of systems. There are four general severity levels that we’ve discussed in this post. These levels can also be customized as per your needs.

Additionally, the best practices for going about this are that you establish clear and contextual definitions of each level and integrate severity into defect management workflows, along with doing the other things we mentioned.