A Quick Guide to Performance Testing for Banks

- September 1, 2021

- maira

With the pandemic now acting as a catalyst for the digitalization of banking, Deloitte’s 2021 Banking and Capital Markets Outlook report has shown the remarkable scale at which several global megatrends, such as digitization, virtualization of the workforce, and corporate responsibility, among others, have accelerated and decelerated.

In order to determine how well banking systems are equipped for the fluctuating changes emerging as a result, performance testing is a simple but effective way to determine how prepared the system is for scalability, among other things.

There are three broad areas that testing for banking apps targets:

- Digital interface – Mobile & web

Digital technologies ranging from mobiles to wearable devices now influence everything – from online banking, cash withdrawals, bill payments, transfers and transactions, analytics and more. Each financial process requires its own software application design. - Core banking and branchless banking

To determine the behaviour of core banking applications, such as Temenos T24, and how adaptable they are to a company’s anticipated growth and evolving business goals. - Banking operations

Legacy banking applications aren’t robust enough to support the maximum number of transactions performed simultaneously, such as bulk-up loads, day-end settlements, financial schedulers etc., which banks do on a daily basis. When it comes to peak times, they’re also less responsive and reliable.

A combination of business analysts, and quality analysts, as we outline below, help determine how to best respond to the business and technological requirements of the bank.

The golden rule of performance testing is to begin testing at the earliest possible stage. Doing so helps software teams identify major issues in the beginning and continue the testing process along with the entire evolution of the application. It’s also essential that performance testing be done wholistically – for instance, as we mentioned above, a system may be able to process transactions quickly, but if it’s utilizing all server resources, then it’s bound to fail because it won’t be able to manage the excessive load.

For performance testing to work, the attention needs to be on the bottlenecks and performance glitches so that the overall performance of the banking system can be improved.

Types of performance testing for banking systems

1. Load testing

Load testing assesses a system’s ability to perform under real-world user loads, ideally before the application is deployed.

2. Stress testing

Put widely in place after the 2008 financial crisis, bank stress tests are used to determine whether a bank possesses enough capital to be able to withstand a financial crisis. A stress test measures the application’s performance in extreme situations, with the objective being to determine the application’s breaking point.

There are standard stress testing scenarios that all banks might experience: significant dips in unemployment rates, stock market volatility, housing prices etc.

3. Endurance testing

On bank closing days, for instance, the institution anticipates continuous loads – endurance testing ensures that the system is equipped to sustain that load throughout that particular window of time. The performance is measured against benchmarks that have been set during the initial performance testing of the system.

4. Volume testing

In volume testing, a large amount of data is injected in a database suddenly – for instance, in a bank transaction involving large amounts of money, the system should be able to support the volume of information being given to it. Testers check how the system behaves under fluctuating database volumes, its reaction time, and determine what is preventing a system from achieving its volumetric target, among other things.

5. Scalability testing

Scalability determines an application’s ability to adapt with increasing productivity as an organization grows. Banks have to grow in order to compete, as well as to increase value for their shareholders, and the software’s infrastructure needs to be able to support not only existing needs, but the bank’s anticipated growth as well.

6. Spike testing

Spike testing refers to the process where testers evaluate how a system responds to increased or decreased spikes in user load – for instance, a utility bill deadline results in an increased number of users utilizing the banking application at a point in the month.

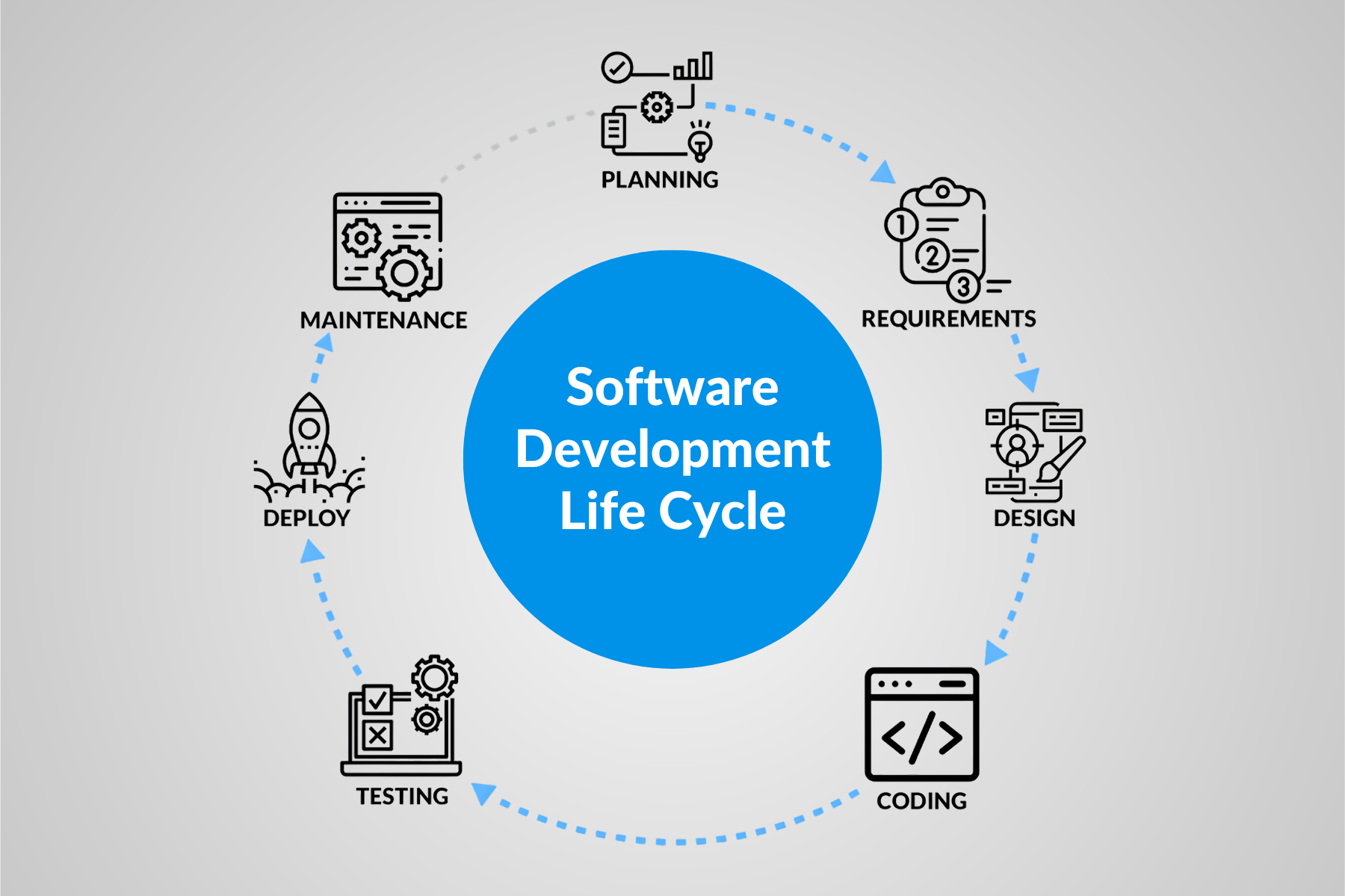

An overview of the process

A performance test for a bank will unfold as follows:

Requirement analysis

Requirement analysis is the step where the performance testing for the banking app begins. Here the testing team tries to evaluate the requirements of testing and outline which of the given requirements they can test.

Requirement review

Quality analysts, business analysts, and development leads review the documents and cross-check to ensure that the workflow of the bank isn’t affected. The Kualitatem team proposes solutions based on the expertise they have with core banking, as well as understanding of the client’s requirements and experience.

Business requirements documentation

Business requirements documents are prepared by quality analysts in which all reviewed business requirements are covered.

Plan and design performance tests

The test team needs to create, verify, and remake specific scenarios based on given features and their requirements. Furthermore, they also need to come up with testing data they can use on their scenarios for scripting, such as banking transactions, back-end schedulers, or integrations with core banking.

Configure the test environment

The test environment comprises of testing conditions such as hardware and software specifications used during the testing procedure. Ideally, it should imitate the environment used by the end-user in their working space. In the banking sector, banks used to give us an internal environment from where the load could be generated to measure the real-time core banking issue, and for end users, they enable us to put load over the Internet to see end-customer issues.

Implement your test design

Develop the tests – for instance, Temenos T24 is designed with Java servlets, and the application adds an extra layer of security. During scripting, the team needs to account for both front-end and back-end sessions.

Executions

In the Test Execution phase, testers carry out testing according to the test strategy approved by the bank’s team to really see the real-time issues that customers and internal bank teams are facing. According to the proposed strategy, we start with the execution to measure the threshold of applications and sustainability of its infrastructure. As a result, the bank team learns and sees the performance issues in the banking system.

Analyze, report, retest

Once the performance test run is complete, the Kualitatem testing team will collect results from all the covered sources and compile them into a recommendations report. This report will highlight key issues, observations, statistics and will make relevant (infrastructure/architecture) recommendations in order to improve the performance characteristics of the system.

The challenges and requirements for banking software are always evolving to meet new trends, but there is certainty in the performance testing process and its reliability. Alongside maintaining the quality of existing functions and services, banks must also scale up to modernize and optimize their infrastructure to meet customer needs.