Temenos T24: The Future in Banking

- November 24, 2025

- admin

Modern banks face strict regulations, complex integrations, and outdated core systems. They need a platform that supports real-time processing, multiple product lines, and constant change while maintaining customer trust. Temenos T24 (Transact) helps modernize account, product, and transaction management.

This article is for you if you work in fintech, core banking, or quality assurance. You’ll learn the capabilities of Temenos T24, why specialized testing matters, and where projects commonly struggle. You’ll also see how to build a testing strategy that reduces risks in upgrades, data migration, integrations, and compliance.

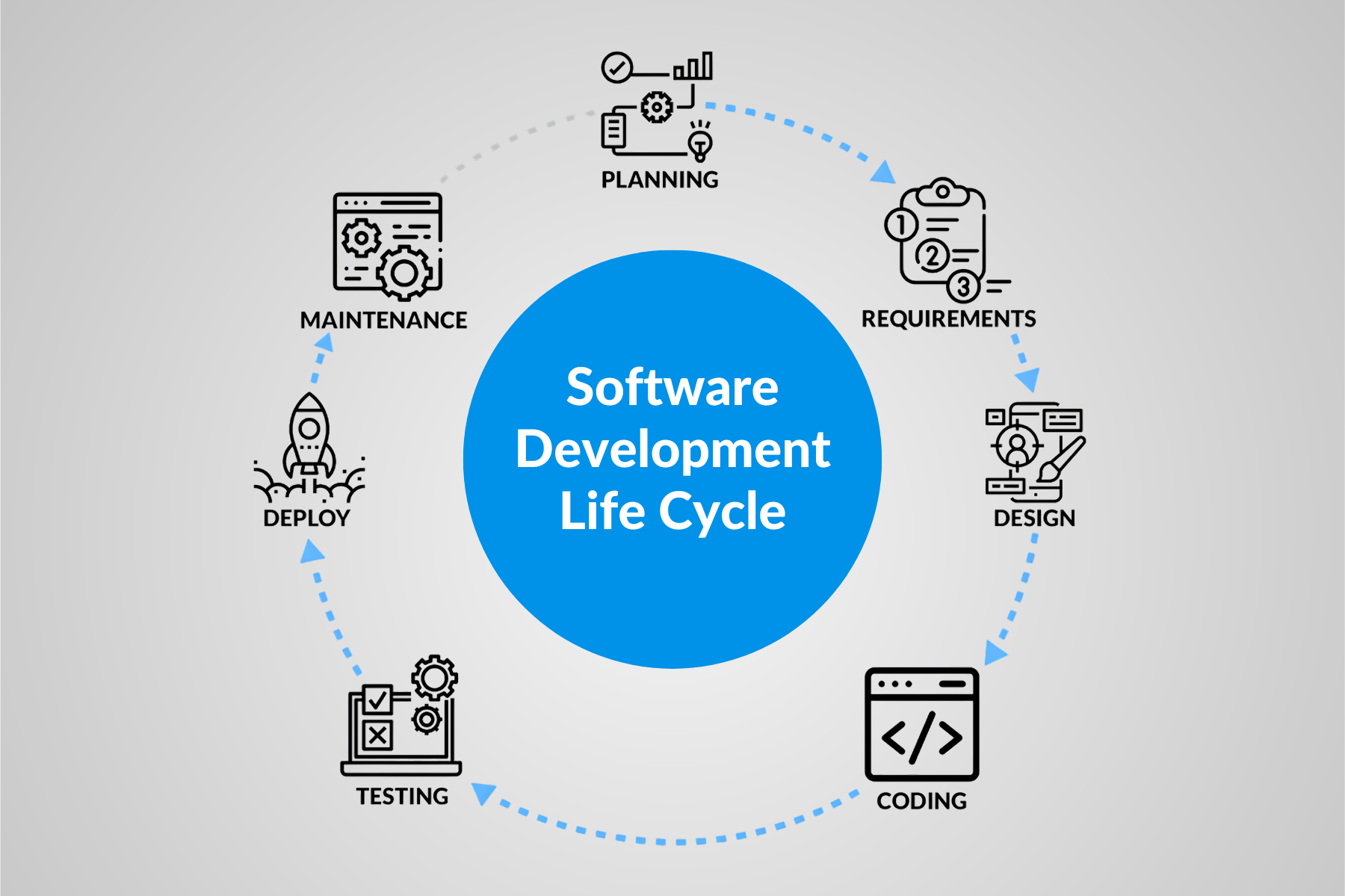

What Is Temenos T24 (Temenos Transact)?

Temenos Transact acts like a core banking engine. It connects to digital channels, payment rails, and regulatory systems. It also tracks clients, accounts, products, interest calculations, schedules, limits, and more.

The platform is constructed as a modular, configurable system from the ground up. Banks can choose from retail, corporate, treasury, Islamic banking, and trade finance modules. They can also expand these options with local regulations and customizations. Strong security, multi-currency support, and real-time processing are crucial. These features let the same engine support different products and regions.

One bank may operate a largely “vanilla” setup due to this flexibility, while another may have hundreds of local rules and unique interfaces. We demonstrate how each implementation can differ from bank to bank in our article on optimizing Temenos efficiency through improved integrations and our guide to customizing the platform for your institution.

Why QA Matters for the Core Platform

Core banking systems are not “just another app.” Payments, interest runs, statements, collections, fee waivers, and more all revolve around them. For balances, product rules, and transaction status, channel systems such as ATMs, branch LOS, internet banking, and mobile apps rely on the core.

Failures are therefore costly in all respects: monetary loss, fines, interruption of operations, and harm to one’s reputation. This risk profile and the requirement that core systems remain stable even as products and channels change form the foundation of our banking software testing and finance QA services.

Banks benefit from an organized QA procedure centered on Temenos Transact:

- Catch defects in complex interest, fee, and limit logic before they reach production.

- Validate that the system can handle peak loads, as we discuss in our guide to performance testing for banking applications.

- Make sure every release, patch, or parameter change is backed by regression coverage that protects existing products and channels.

- Support ongoing banking technology modernization instead of freezing change because “the core might break.”

Temenos Transact testing is the practical method by which banks safeguard daily stability and business expansion as they transition away from legacy cores.

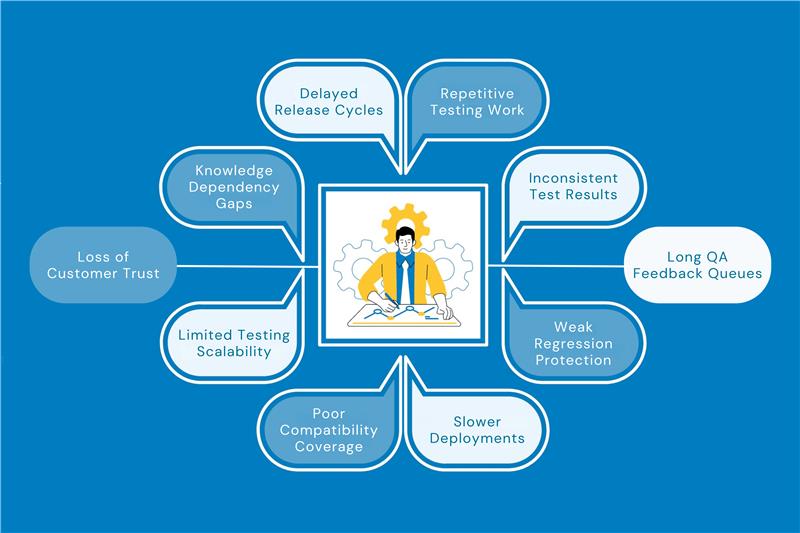

Key Testing Challenges in Temenos Projects

Even experienced banking teams run into similar T24 implementation challenges again and again.

Some of the most common:

Complex parameterization

Layers of tables and parameters are used to build products. Only after month-end or campaign periods can a minor misconfiguration alter interest postings, repayment schedules, or fee behavior in subtle ways.

Migration of legacy data

Data is rarely stored in a clear, consistent format by old cores. One of the main causes of errors is the transfer of decades’ worth of transactions to a contemporary schema. We describe in our article on the difficulties in testing banking applications how difficult it can be to migrate test data when formats and regulations are constantly changing.

Heavy integrations

The core communicates with data warehouses, CRMs, anti-fraud engines, AML systems, and cards. Especially during upgrades, any modification can have an impact on dozens of interfaces.

Regulatory pressure

AML, KYC, sanctions, Islamic banking rules, and local reporting formats vary by region and often live inside or around the core. Missing a corner case can quickly become a compliance issue.

Multiple environments and versions

Banks frequently use slightly different core versions for development, SIT, UAT, and pre-production environments. It’s challenging to keep them properly together for trustworthy testing, particularly when local teams make configuration changes.

Because of these difficulties, Temenos Financial Software Testing Transact is more about comprehending how data, rules, and integrations flow together throughout the ecosystem than it is about “clicking screens.”

Ensuring Accurate Data Migration

One of the riskiest stages of any significant upgrade or core replacement is typically data migration. Older systems may compress transaction history, store dates in various formats, or combine several meanings into a single field. Problems may arise weeks after go-live if that data is transferred without thorough verification.

Comparing record counts is only one aspect of a good migration testing strategy. It confirms things like:

- Opening and closing balances before and after migration for different product types.

- Interest and charges recalculations across sample accounts with varied histories.

- Historical transaction timelines, so there are no gaps or duplicates in customer history.

- Mapping of product codes, customer segments, risk flags, and accounting rules.

Through our data migration testing services and our Temenos-focused case study on data migration and GL reconciliation, we’ve seen how migration testing usually spans functional checks, reconciliation, and performance tests in parallel.

Long after launch, migration errors may manifest as GL mismatches, stuck postings, or incorrect interest accruals because the core frequently operates on or feeds the general ledger. GL reconciliation, back-dated postings, and cross-system comparisons with channels, reporting systems, and external feeds are therefore necessary for test design.

Getting the migration right is frequently the key to gaining or losing the trust of finance, risk, and audit stakeholders for teams working on banking technology modernization.

Managing Integrations and Compliance

Seldom does the core exist alone. It is situated at the heart of a network of file interfaces, batch jobs, and APIs. Every integration is a contract with conditions, such as timing, data formats, and error-handling procedures, that must remain valid as the platform changes.

As far as integration goes, we assist QA teams in mapping outbound and inbound interfaces for every business process and creating tests that cover failure modes, negative scenarios, and positive paths. Timeouts, duplicate messages, incomplete updates, and recovery behavior following restarts are a few examples of this. Our work on performance testing for banking applications shows how these flows behave under realistic load.

On the regulatory side, the core often triggers or feeds:

- Engines for AML and sanctions screening

- Customer risk scoring and KYC checks

- Files for tax and regulatory reporting

Our insights on testing challenges in banking applications and on keeping a strong testing strategy in banking line up directly with these integration and compliance concerns. The question is never just “does the file get generated”; it’s whether the data correctly reflects regulatory rules across different products, time periods, and channels.

Why Specialized Financial QA Matters

Banks frequently argue over whether they need testers who have worked on several Temenos-based projects or if generalist QA can handle core banking programs. In reality, a purely generic approach cannot match the benefits of specialized banking quality assurance.

Specialized teams contribute domain-aware test design. Testers who are familiar with GL posting patterns, interest capitalization, and local regulations design scenarios that closely mimic real-world user and customer interactions with the system.

Additionally, they create a more robust regression plan. They concentrate on high-risk areas, such as interest runs, schedules, batch jobs, fee calculations, and interfaces to AML and reporting systems, rather than distributing their efforts evenly.

As we explain in our case study on performance testing of a Temenos-based core and in our guide to test data management for performance testing, that can include closing days, salary runs, public-holiday traffic, or marketing campaigns.

As a result, business and technology stakeholders receive feedback more quickly and with fewer blind spots.

Temenos Transact Projects With vs. Without Specialized QA

A simple way to see the impact of specialized Financial Software Testing is to compare typical project outcomes.

| Aspect | With specialized core banking QA | Without specialized core banking QA |

| Understanding of product rules | Test cases reflect extreme situations and actual banking products | Many scenarios miss business-critical combinations |

| Data migration confidence | Test cycles that incorporate structured reconciliation and history checks | Migration treated mainly as a one-time technical task |

| Regression coverage | Stable packs with a focus on risky procedures and modifications | Ad-hoc checks around “what changed this release” |

| Integration and compliance issues | The majority of SIT/UAT defects were identified through a clear root-cause analysis. | Integrations often fail in production under real workloads |

| Time to adopt new features | Quicker adoption due to the visibility and control of risk | Change freezes are common; teams fear breaking the core |

For banks planning large banking technology modernization programs, this gap grows with every upgrade, rollout, and regulatory change.

Bringing Temenos Transact Testing into Your Next Banking Project

Treating QA as a parallel track rather than a late-stage gate is beneficial if your bank is preparing a new rollout, upgrade, or regional expansion on this platform. A good place to begin:

- Clarify your risk map: List the flows that you cannot afford to disrupt, such as treasury operations, card limits, loan interest runs, and salary processing, in collaboration with the business, operations, and risk teams.

- Map those flows across systems: Identify which steps live in the core, which live in channels, and which touch external systems like AML, CRM, or data warehouses. Our work on automating end-to-end testing for internet banking applications is a good example of how to think across systems, not just inside the core.

- Invite those who are familiar with the platform: You want testers who have experience with Temenos Transact testing across several banks and who know how to integrate functional, performance, and data-focused testing, whether that means our team or your internal experts.

From there, you can layer in automation, performance testing, and security reviews. Our mix of banking and finance software testing services and Temenos-specific case work like performance testing of Temenos T-24 and data migration and GL reconciliation for Temenos T24 shows how banks turn these ideas into real project outcomes.

In the long run, the platform can support growth, maintain regulator confidence, and safeguard customer trust when quality assurance is viewed as an integral part of the program rather than an afterthought.